#82 Less German-Ness

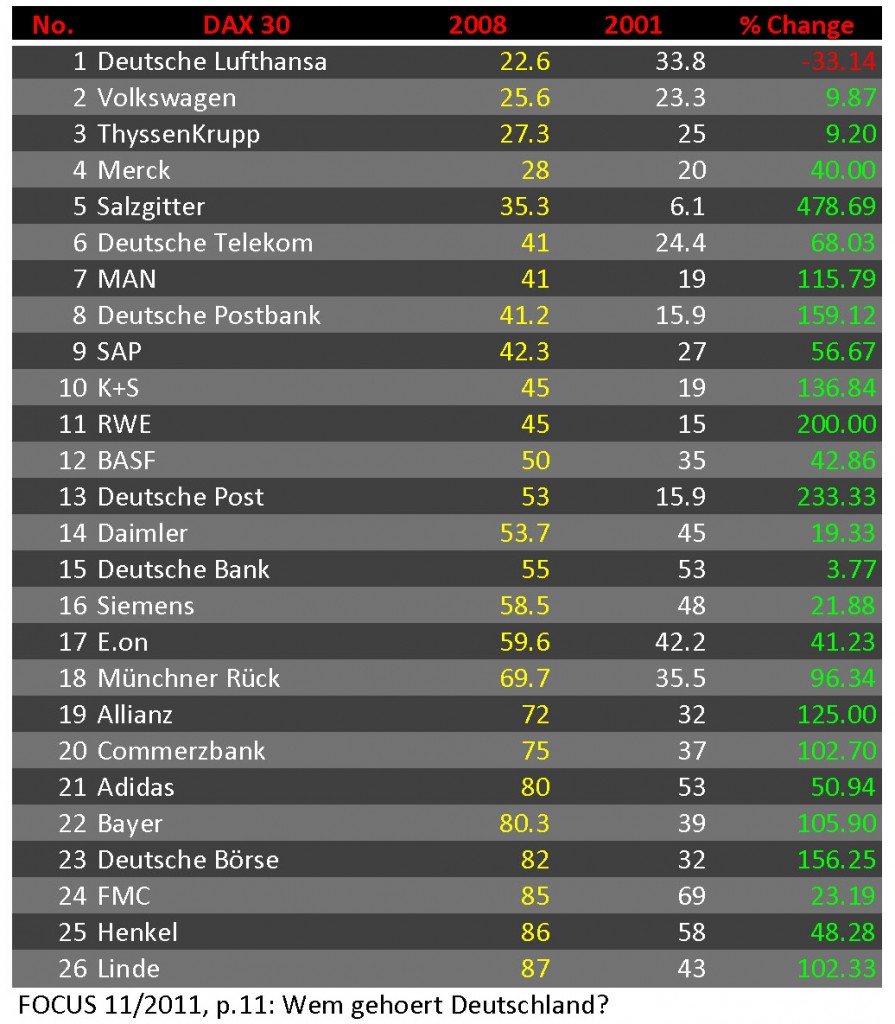

You have certainly heard of Adidas, Bayer, Henkel, Linde, or Siemens – all German companies and major players on world markets and a major source of pride for most Germans. Well, think again. It’s been a while since I read this feature about foreign ownership of German companies in a German weekly. For the vast majority of the 30 largest German companies that are part of the DAX stock index, foreign ownership has increased between 2001 and 2008. The smallest increases were at Deutsche Bank (3.8 %), ThyssenKrupp (9.2 %), and Volkswagen (9.9 %), and the largest at energy giant RWE whose foreign ownership shot up by 200 % (from 15 % to 45 %), Deutsche Post (233.3 %), and steel giant Salzgitter which increased foreign ownership almost five-fold. The only company where foreign ownership actually decreased was Lufthansa, where it fell by 33.1 %. On average foreign ownership for the largest German companies listed in the DAX rose by an astonishing 97.9 %. What’s most interesting is that for 21 of the 26 companies for which data is available foreign ownership is larger than 40 %. For 15 it is even larger than 50 %. Professor Ghemawat is certainly entitled to his own opinion, but this sounds all pretty global to me….

January 5, 2013 @ 4:44 pm

The list above shows an interesting overview of German brands which have at least a minority interest of foreign owners. I was astonished especially of brands like ThyssenKrupp and Volkswagen because I always associated these companies as really German. After my research I found (for me) an even more interesting article about brands that sound 100% German but are 0% German anymore!

For example AEG Hausgeräte (washing machines – since 1994 Electrolux – Sweden), Telefunken (TVs – since 2006 Profilo-Telra – Turkey), Grundig (TVs – since 2004 Beko Elektronik – Turkey), UHU (glue since 1994 Bolton Group – The Netherlands), Bauknecht (washing machines since 1989 Whirlpool Corporation – USA).

In my opinion Germany is still associated with good quality around the world. For me that is the only reason why new owners keep the German name to bluff consumers about the country of origin.

Of course this is done also the other way around. For example Nutella or kinder-Schokolade is associated with Germany but actually Ferrero is Italian.

To explain this phenomenon of foreigners to invest in German brands or even take over the companies I have undertaken it in Hofstedes dimensions. I think the most important dimensions in this case are the uncertainty avoidance and the long-term orientation.

For me these are the most popular associations with German workforce.

The uncertainty avoidance dimension expresses the degree to which the members of a society feel uncomfortable with uncertainty and ambiguity. So foreign investors can rely on a profitable brand when investing in a German company. German people prefer to control the future instead of just let it happen.

The long-term orientation dimension can be interpreted as dealing with society’s search for virtue. In societies with a long-term orientation, people believe that truth depends very much on situation, context and time. So investors can trust in German companies and brands and be sure to have a management that is really interested in a long-lasting company history.

So for me it does not count on which percentage a company or a brand is German as long as German value is given.

March 10, 2019 @ 7:54 pm

One of the most striking thoughts related to this blog is the following. According to media the DAX 30 companies pay € 30 billion dividend. But over 19 billion euros of it are transferred to foreign accounts, while investors from this country suffer. The fault is indeed home made since only around 13 percent of private wealth is invested in equities. One could believe that the Germans lack confidence in their local economy, although investors from all over the world recognize the strength of German companies, the Germans are not aware of the topic of corporate participation and thus many private investors leave their fingers from stocks. Striking indeed when one thinks about the motto driven by the media that “dividends are the new interests”. There are such blue chips like Daimler with the largest dividend check of with 3.5 billion euros, and I am relieved to see that my own company Rheinmetall with a plus of 267 percent raises the strongest and at Fresenius the shareholders can be happy about the 24th consecutive increase. Other top dividend payers are Allianz (3.3 billion euros), Siemens (3.1 billion euros), BASF (2.7 billion euros) and Deutsche Telekom (2.5 billion euros). All good reasons to consider investments in the DAX 30, especially if one considers the interests on interests effect.