#70 The Phoenix Rises from the Ashes … in China

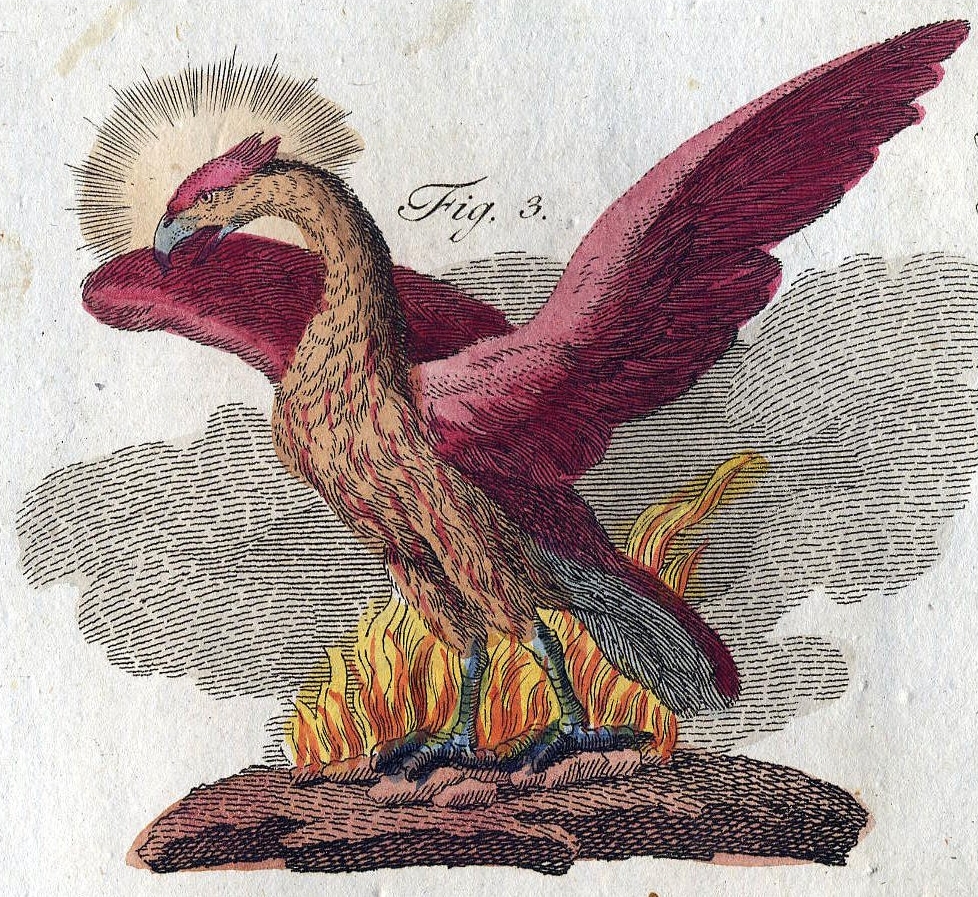

Of course, what is commonly referred to as the Chinese phoenix, the fenghuang, only distantly resembles the phoenix of the West. So, erudite reader, please forgive the amateurish use of the phoenix as a metaphor for what’s going on in China’s automotive sector. Mercedes, BMW, or Audi are all reporting very positive developments from the Chinese market. This confirms what insiders to the automotive industry and experts in cross-cultural marketing have long pointed out silently. It’s not necessarily (only) available income that drives purchasing decisions, but national culture plays a big role, too. Income levels in China would suggest that smaller models are sought after, but the opposite is true. Status, power and prestige are very important elements of Chinese culture. Several years ago now, Volkswagen had planned to rapidly increase market share in China by offering a small car – assuming that with rising levels of affluence, everyone would buy a small, entry-level car. Guess what, they didn’t. The polo was simply too small for the Chinese market. Today, larger Volkswagen models such as the Passat or the Tiguan are doing a lot better. Owning a luxury car is the ultimate sign of social status, and so demand in the premium automotive segment is on a constant rise. In July, Audi sold about 50 percent more cars in China than last year, BMW about 80 % more and Mercedes-Benz even tripled its sales. And all of this despite the rather high luxury taxes in China which raise the prices of the flagship models – the S-Class, the 7-series, or the A8 – to about double from what they are in Europe. These developments certainly come at the right time for luxury carmakers whose sales have been less than favorable in their core markets in the West in past years. The Chinese fenghuang is a symbol of virtue and grace – very similar to what the Mercedes brand stands for. Maybe my use of the metaphor isn’t that off after all.

January 15, 2011 @ 1:58 pm

Well, I really like the use of the phoenix as a metaphor! It is a mythical figure – a bird that burns fiercely at the end of his life-cycle. But we know that this is not the end of the story. A new, young phoenix arises from the ashes that remain. The phoenix and the whole myth about it is a symbol of rebirth, immortality, and renewal. In terms of transferring this idea to economical processes, I would rather compare it to a product relaunch or a repositioning (of a product or a company) than to the development within the automotive market in China.

I think the “sudden” success of these mentioned automobile manufacturers can be put down to a simple market mechanism: supply meets demand. I think these companies raised awareness about the expectations and desires (in a car) of the Chinese, adapted their range of products provided in China and thereby increased their sales. Of course the Chinese have a very individual sense of aesthetic as well. Therefore, the car manufacturers customise their cars. The VW Passat, for example, is sold under the name Magotan in China. Of course VW didn’t just change the name of this car, but also the product attitudes in order to comply with the clients’ desires.

The income level in China might be low, but we have to keep in mind that the Chinese are very thrifty people and therefore are able to afford luxury cars. As mentioned above, social status and especially the car as a status symbol are of high importance in China. Status symbols indicate (as the name obviously says) social status, but also power and success. Even if they have little money, they spend it on things which are important to them (as we all do). So, I totally agree with the point that culture has a deep impact on buying decisions.

December 2, 2012 @ 9:32 pm

I absolutely agree with you as well – culture definitely does impact costumers’ behavior and consumption.

I am not surprised that the Chinese prefere to buy larger Volkswagen models such as the Passat or the Tiguan instead of the Polo. If you look at Hofstede’s cultural dimensions you will see that China’s score regarding power distance is 80, which is very high. In countries with high power distance like in China, people who earn less and have a lower social status use luxury status brands to compensate their lack of social status. They want to have the same status symbols like the richer ones. For that reason, desires of gaining social status and social prestige can be fulfilled through the consumption of more expensive cars. Additionally, societies of high power distance are more likely to value “design” and “international image” in a purchased car.

Regarding individualism you can see that China is a highly collectivistic culture (scored 20). This means on the one hand that the Chinese prefer in-group decisions instead of individual decisions and maybe also therefor group members influence the buying decisions of the other ones. Thus, the community encourages its members to buy similar goods.

On the other hand, the concept of „face“ is of great importance. As a result, asian customers place more emphasis on publicly visible possessions and their public meanings. Mien-tsu (face) is often represented by symbols of prestige or reputation gained through the possession of valuable products and the estimation of other members of the society. And as you already mentioned, owning a luxury car is the ultimate sign of social status.

Since marketers realized the needs of the Chinese culture and the demand of the Chinese market, both can profit from it – the Chinese customers and the automotive industry.

April 16, 2014 @ 4:39 pm

From my point of view this blog covers one of the most important and most current issues in the automotive industry. After 15 years working experience at Europe’s largest “car dealer”, Porsche Holding Salzburg (meanwhile integrated in the VW Group), I want to point out several aspects in this context.

1) How is it possible to sell successfully expensive luxury cars in countries with low income levels? Many Austrians asked me this question when I moved to Serbia for 2 years as a financial director for Porsche Serbia (importer and dealer of brands VW, Audi, Seat and Porsche in Serbia). I think there is a mechanism who works similar in almost each country of the world. There is always a little percentage of really rich people and a certain percentage of people with relatively high income. Average values often lead you astray. From perspective of a single enterprise it’s sufficient to reach this part of potential customers. As mentioned in the blog these customers want large and (rather) expensive cars to increase their social image. Beside this, cars “made in Germany” stands for high quality world-wide.

2) Market figures. In 2013 18 million new passenger cars were registered in China. China has a population of 1.34 billion. This gives a ratio of 1.3 % new passenger car buyers. Germany has a population of 80 million and sold 3.44 million new passenger cars. This gives a ratio of 4.3 %. In other words: the relative German car market is nearly 4 times higher than the relative Chinese car market. Germany is a high developed market with consistent or even slightly falling sales volume, China is an emerging market with plenty of room for growth.

3) And this is the main reason why global car manufacturers have to enter markets like China – growth. If they would stay in their “old” developed markets their perspective would be decline and fall. After eruption of the financial crisis the CEO of Fiat and Chrysler Group, Sergio Marchionne, predicted in 2009 that only six large auto groups (car manufacturers) will survive globally. “The only way for companies to survive is if they make more than 5.5 million cars per year,” he told the European edition of Automotive News, an industry publication. Many of his competitors and many experts in Europe shared and still share this opinion. Tough global competition, cost pressure, demanding customers, technical challenges and global environmental awareness are just a few factors that underpin this assessment. For survival it’s necessary to utilize economy of scales, to utilize supply chain management, to offer a continuous range of models, to invest in marketing and build strong brands, to operate globally, to develop excellent distribution channels and to grow and conquer market shares. To do that, you have to be a global player. In 2013 each of the top three car manufacturer – Toyota, GM and VW – sold between 9 and 10 million cars. Next come Ford (6.3m), Nissan (5.1m) and Hyundai (4.7m).

All brands together VW-Group sold 3.3 million cars in 2013 in China – this is 37 % of their whole sales volume!

February 19, 2022 @ 8:50 am

I totally agree with the information of the article, that i t’s not necessarily (only) available income that drives purchasing decisions, but national culture plays a big role, too. The Chinese income levels are very lower the European and American income levels, but luxury cars are sold better in China than in Europe and the U.S. The reason could be the different culture and habits between Chinese and European and American. Chinese think the expensive product could show status, power and prestige. They could save money for a long time to buy a luxury. In America, people could think the car is only a tool to instead of walking. Therefore, most of American might decide the level of car based on available income. They are willing to spend the money to enjoy their life instead of the nothingness, such as status, power and prestige. However, Chinese people consider buying a car based on a lot of factors, such as available income, status, power and prestige, so most of Chinese would buy the level of cars that is higher than the level of available income. They are willing to spend money to show their rich, power, and status. Therefore, as global companies, it is necessary to consider the different national cultures.