#185 The Secrets of Victoria’s Secrets’ China Challenges

During the last decades, US-based brand Victoria’s Secrets pursued an ambitious global strategy of worldwide expansion. Like many other consumer brands, Victoria’s secret eyed the world’s most populous market, China, and its growing middle class that had a similarly growing appetite for Western goods. However, the path was rockier than they thought.

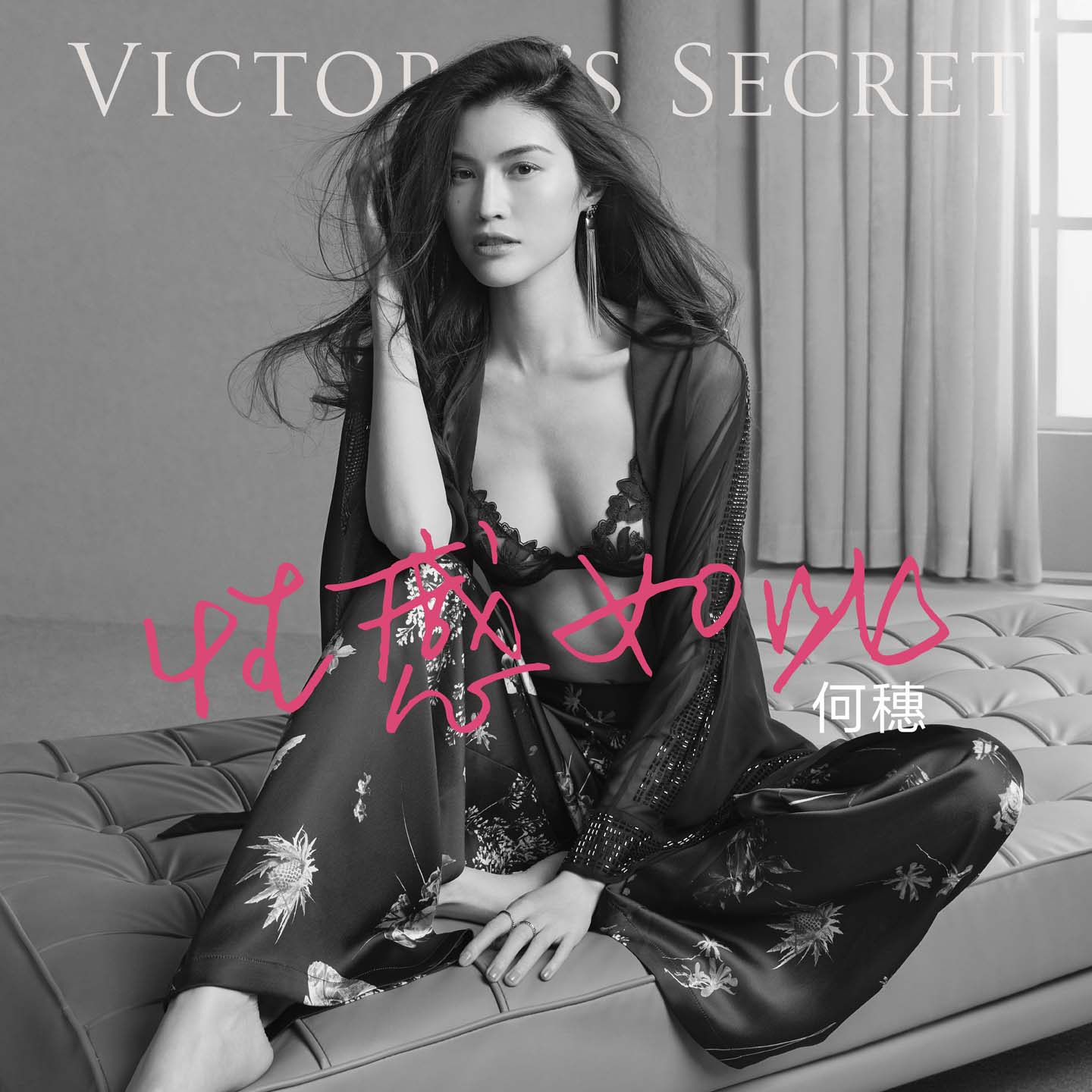

Victoria’s Secrets’ marketing strategy relied heavily on a specific type of glamour and sexiness that did not resonate as well with the Chinese audience as expected. The brand’s iconic fashion shows and marketing campaigns, celebrated in the West for their flamboyance and celebration of femininity, were sometimes seen as out of sync with Chinese cultural norms and consumer preferences. The brand’s 2017 Fashion Show in Shanghai’s Mercedes Benz Stadium especially stood out as a significant failure. It was meant to be a grand entry statement but faced several issues, including visa denials for some key models and performers, logistical challenges, followed by a mixed reception from the Chinese audience and media. A similar fashion show in 2019 was canceled on short notice, and resources were diverted to Chinese eCommerce giant TMall’s “See Now, Buy Now” online show that streamed on social media platforms such as Weibo or Tiktok. The brand also underestimated the competition from local and international lingerie brands that were already established in China. These competitors often had a better grasp of the local market, and Victoria’s Secret was slow to adapt to the e-commerce boom in China, a critical channel for retail success in the region, allowing local competitors like Aimer, Bananain, Cosmo Lady, Neiwai, or Ubras, and international brands such as Uniqlo or H&M to capture market share much faster. Victoria’s Secret products are positioned as premium, with pricing much higher than many local alternatives. This made it challenging for the brand to compete in a price-sensitive market like China, especially since Victoria’s Secrets also underestimated simple issues such as import duties. In a market where consumers are always out there for the best deal and have access to a wide range of products across different price spectrums, Victoria’s Secrets’ pricing policy was not competitive enough. The brand’s aggressive store expansion strategy in China also did not yield the expected returns. Like other foreign entrants had learned earlier, flagship stores, including the one that opened with much fanfare in Shanghai in 2017, incurred high operational costs without generating proportional revenue. The choice of other store locations, while prestigious, may not have been the most strategic for capturing the broader market. Of course, the COVID19 pandemic also didn’t treat the brand well, and store closures, including a complete pull out from the UK, followed around the globe. In 2022, Victoria Secret had plans to withdraw from China, but then decided to stay and refocus its approach. Later in the same year, it entered a joint venture with Hong Kong-based lingerie manufacturer Regina Miracle International that would manage all of Victoria’s Secrets’ offline and online store. Victoria’s secret finally bowed to the pressure to localize by entering into agreements with Chinese brand ambassadors such as celebrities Yang Mi or Zhou Dongyu as well as “brand friends” celebrity agent Yang Tianzhen, fashion photographer Chen Man, and Zhao Xiaotang from girl group The 9, and by signing Chinese designer Rui Zhou. As plans were announced to open another 100 new stores across China, the brand closed its flagship store in Beijing in 2023.