#147 Vulnerable Emerging Markets

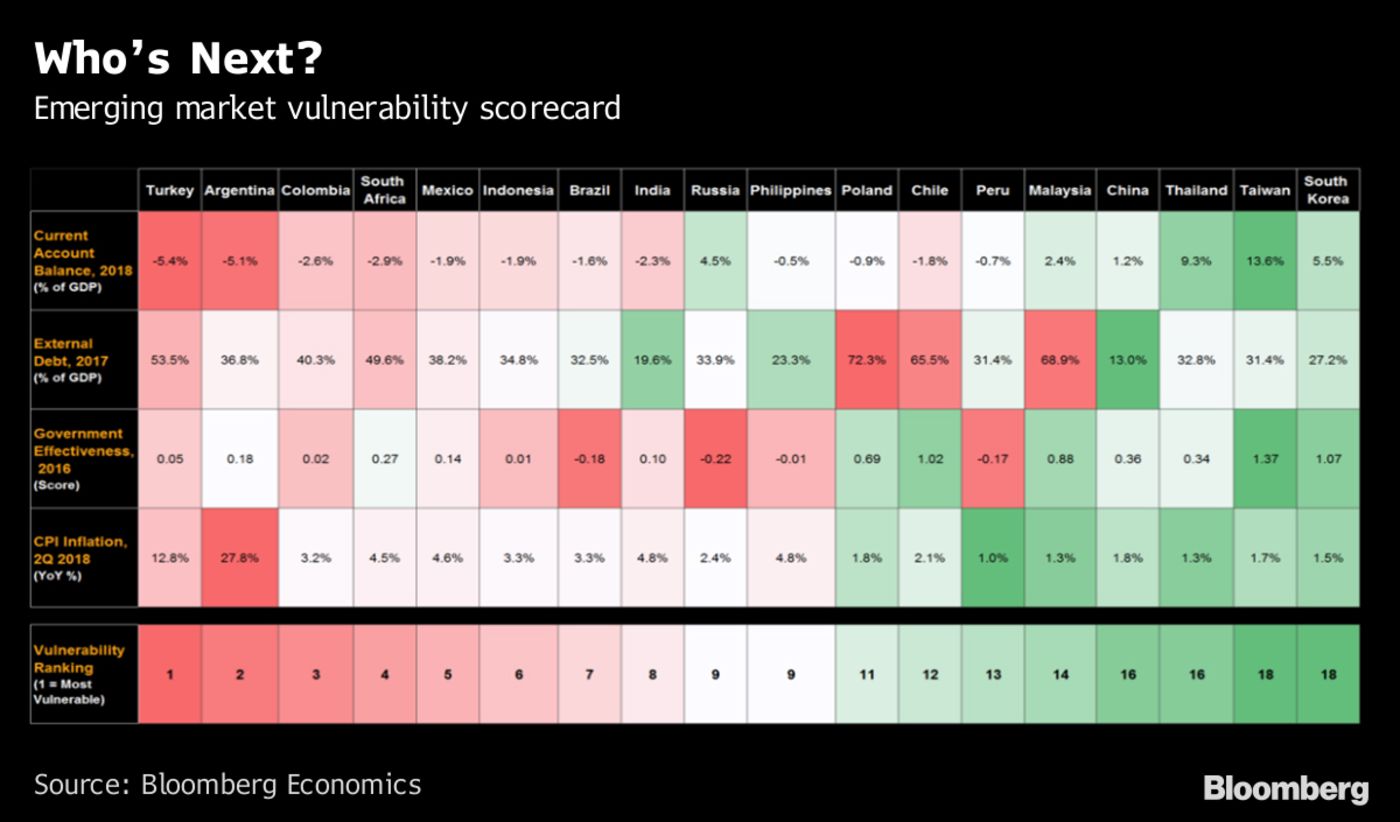

Last month, Bloomberg published a “Vulnerability Ranking” for 18 emerging markets ranging from Turkey to Taiwan. The ranking assesses these markets along four criteria – Current Account Balance, External Debt, Government Effectiveness, and Inflation. To no one’s surprise, Turkey and Argentina lead the pack in their vulnerability, while countries such as Saudi Arabia, China, Thailand, South Korea, or Taiwan rank highly in their attractiveness. Based on these rankings, it would only be logical to conclude that the former countries are “stay away markets” for foreign companies considering expansion, while suggesting an automatic go decision for the latter countries. While there is some logic to this, there is something deeply wrong with such a simplistic conclusion. There’s nothing wrong with the thoroughness of Bloomberg’s ranking, but it shares two important limitations with other, similar risk rankings or indicators of which there are many: the EIU/Economist Intelligence Unit’s Country Risk Service (CRS), the Robinson Risk Index, Political Risk Services (PRS) Group’s International Country Risk Guide (ICRG), or the increasingly popular World Bank’s Ease of Doing Business Index, to name but a few.

First, no matter how comprehensive these composite indicators or rankings are, and regardless how thorough their data collection and analysis are, most of them make a rather subjective call over which factors are important and which ones are not. Often, they focus solely on economic indicators and, sometimes, also include a smaller set of factors related to government and governance. They are therefore both heavily skewed and never complete as they ignore other variables that are often very important at the organizational or individual levels such as, for instance, culture. For instance, according to the Bloomberg Vulnerability Ranking, Taiwan and Saudi Arabia do look similarly attractive, but whoever has ever done business in both countries will readily tell you that there are distinct differences that impact a company’s ability to compete. Second, the vast majority of such indices and rankings measure at the country level. They therefore suggest that these markets are equally attractive regardless of industry or product category. That would mean that a market that is highly ranked in its attractiveness by one of these indicators would be equally attractive to Apple in marketing iPhones as it would be to a manufacturer of rooftop solar equipment or beef halves. All such indicators therefore provide important orientation at the macro-level, but they should never be used in lieu of a more thorough and specific investigation into the risks and attractiveness of alternative country markets (industries, and products).

September 19, 2018 @ 8:04 pm

I thoroughly enjoyed this topic as it’s interesting to know which countries are showing promise for their emerging markets. This tool could be helpful during a PEST analysis or a beginning phase of target market selection. The emerging markets would be an initial elimination tool for the countries macro-economics as an indicator of economic prospect.

Some other very important items to consider when doing a target market analysis would be the industry and product or organization specific criteria. As mentioned in your article it mentions that if this tool is the only criteria used that it could misleading as an iPhone might not have the same market attractiveness as beef rounds. Performing an industry analysis during the target market selection would allow for a thorough review if there is a demand or market opening for your firm’s product, this can also happen while going through a Five-Forces Analysis.

While reviewing an organization and its products ability to enter a new market there will be language barriers as well as culture. Using the tools such as the World Banks Ease of Doing Business (as mentioned above) or Hofstede’s Insights to cultural dimension would be a starting point. It would also be important to find a partner or consultant from the prospective country that could help with the cultural transition into market.

It will always be important for organizations to review internationalization from multiple points of view as well as use multiple tools to evaluate readiness and fit of market. If a company does not rush and slowly utilizes all these indicators, although costly and time consuming, they can be successful.

September 21, 2018 @ 11:25 pm

Interesting post! I agree that using only one indicator, such as Bloomberg’s “Vulnerability Ranking,” when making a decision to enter a foreign market would be unwise. I do think indicators such as this contain valuable information, however, especially given the recent levels of inflation in both Turkey and Argentina, but they should be used in concert with other indicators and only after a thorough analysis of a company’s corporate and product readiness has been performed. Furthermore, as you rightly pointed out, culture is one of the most important considerations a company should take into account during the target market selection phase of internationalization. It is surprising how many companies get this wrong and when they do they often fail spectacularly.

One example of this is Foster’s market entry into Vietnam. The short version of the story is, Foster’s attempted to enter Vietnam as a premium beer by positioning themselves as “The Australian Styled Beer”. This did not jive well with the Vietnamese consumer and they ultimately had to sell off their brewing operations as a result (Vietnamnet 2013). This could have likely been avoided if they had done their due diligence. As Katie pointed out in her response above, an effective way for companies to avoid the fate of Foster’s might be to hire a consultant that is experienced with the culture in question in order to ensure the company doesn’t step on any cultural landmines. From our research thus far it almost seems as though many companies enter foreign markets on a whim, then are surprised when it doesn’t work out. Entering markets requires planning, time and research, therefore if a company isn’t willing to do these things they have no business entering foreign markets in the first place.

Resources

Vietnamnet. (2013, May 9). The three big guys who failed to conquer the Vietnamese beer market. Retrieved from Vietnamnet: https://english.vietnamnet.vn/fms/business/73501/the-three-big-guys-who-failed-to-conquer-the-vietnamese-beer-market.html

March 17, 2019 @ 3:04 pm

I fully agree with the conclusion of the blog post. A single indicator or benchmark might deem useful to get a first orientation but must not be used as the only source for the target market selection process.

Indicators and benchmarks per definition summarize and simplify information to make the information easier to read, measurable and comparable.

However, to use these factors as a reliable decision base, one needs to understand how these factors are assembled, the purpose of these numbers and the audience for which this indicator is intended (McDowell, 2017).

With regards to market selection, only a holistic and systematic approach will lead to a successful selection of the right market and related market entry mode. Ideally, a decision for a specific market is based on a reasonable and reliable set of a different kind of information’s carefully analyzed in view of the internalization readiness of the company and its products.

References:

McDowell, R. (2017, October). Signs to look for: Criteria for developing and selecting fit for purpose indicators. Retrieved from http://www.ourlandandwater.nz/assets/Uploads/Indicator-thinkpiece.pdf

March 28, 2019 @ 6:57 pm

Following the post #147 Vulnerable Emerging Markets I have to admit that I fully agree on the fact that following those four indicators is not providing a representative picture of the countries and their respective markets. I assume that most companies take a Pro-Active approach of market selection. The goal of a market analysis is to identify the most attractive ones with the biggest potential and the lowest risk.

The tricky part is to identify the relevant indicators which are very different for B2B or B2C businesses and also strongly depending on the product itself. Even if the indicators are identified it is too much data to be handled to have the most promising market detected in just one round of evaluation.

I recommend to follow the comprehensive target market selection model which follows a three-step approach with different criteria.

Firstly, an elimination round is performed utilizing the “PEST” (Political, Economic, Social and Technological) analysis on a big number of countries. Secondly a ranking round is done which uses Porter´s five forces framework to go deeper in the industry level breakdown. Lastly the few left markets are analyzed using either value chain or SWOT (Strength, Weakness, Opportunity and Threat) analysis.

April 8, 2019 @ 12:25 am

This was a very informative post; over the course of this class we have seen a number of different graphs and comparables and each of them share a tremendous amount of information. This blog post was eye-opening for me in a sense that regardless of all the data available to us, we must always think critically and find the most relevant data or lack of it. Building upon what we have learned so far, a market may seem attractive and a country may be in a very favorable shape economically, politically, etc, a company must still be able to offer a product or service that the country has demand for. What might be a hit product in China would not necessarily be lasting in Saudi Arabia. So companies must focus on a variety of research and data to make a decision before they can enter a new country. Additionally, there are cultural differences based on each country that numbers do not show easily.