#130 The Global Top Five

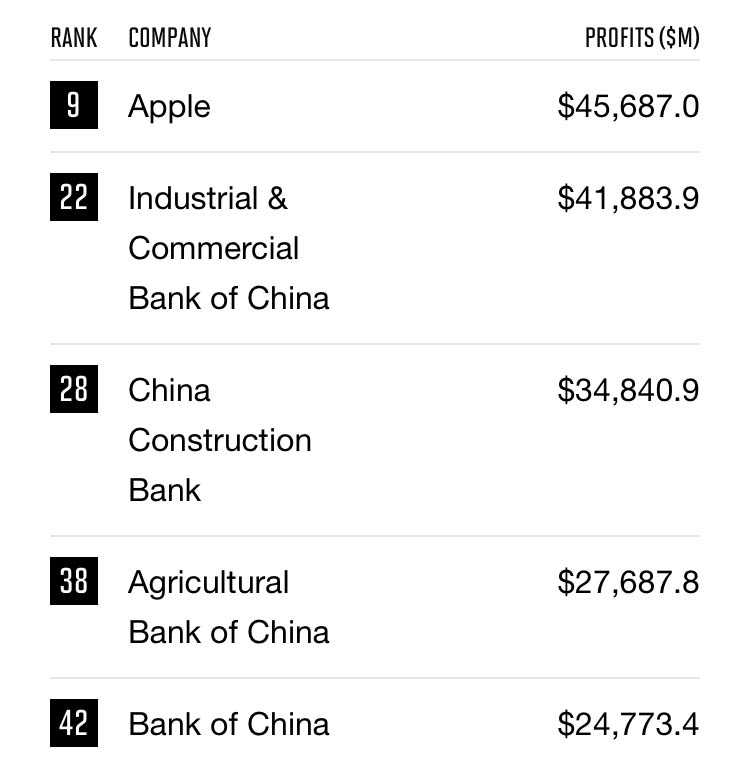

The educator in me has great fun having students or audiences at speaking events guess interesting factoids from the world of international business, especially if the exercise creates a great teachable moment. For instance, based on the 2017 edition of the Fortune Global 500 list, I often ask students what they think the world’s most profitable company is. Most of the time, they get it right by guessing Apple. But then, when I ask about the second most profitable company, the fun begins. Common guesses are Google, Exxon, and the like – all large, American corporations. The correct answer, of course, is Industrial & Commercial Bank of China, with profits of close to $42 billion. Then I ask for the third most profitable company. There are still a few hard core traditionalists who think that it must be a US-based company, but others start to waiver and name, for instance, pharmaceutical giants like Gilead. The reality is that the number three, four, and five spots are all taken by Chinese financial institutions – China Construction Bank, Agricultural Bank of China, and Bank of China. There is, of course, an industry bias in these rankings, but generally it is also a good indicator for how the world economy is changing. In 1995, the US, Germany, and Japan where the world’s three leading export countries (in this order). In 2005, Japan was pushed from third place by China, and Germany had taken the number one spot. In 2014, China has by far become the largest exporting country in the world, followed by a distant second, the US, and Germany. One could jokingly shrug all of this off by saying that we all better learn Mandarin, but there is a more serious reality hidden behind the facts. The world economy continues to change and globalization is the name of the game, whether we like it or not.

April 14, 2018 @ 8:33 pm

Thomas L. Friedman’s ‘The World is Flat’ is a great eye opener on how fast the world moves today and creates the understanding of the pace of globalization. People are more and more able to be collaborate, compete and cooperate with others from different cultures, educational systems, languages, and even religions. We are trained to deal with diversification, our communication technologies allow real time information and exchange, no matter where in the world we live and organizational designs develop into holocratic organizations with virtual network structures being located all around the globe to act and move as innovative, competitive and fast as possible.

Some words to China: Around 20 years ago I made some business English courses in the UK. Around 80% of the students came from China, spending up to a year on intensive language training to be equipped for their business careers in an international context. Europe built barriers over the last decades to limit imports from China and protect their economies. One belt, one road is the world’s biggest infrastructural project under design right now. Two routes will be built to intensify the trade from Central Asia via the Middle East and Russia to Central and West Europe on shore and from South East Asia to Middle East, East Afrika and Europe on the sea. The ‘New Silk Road’ connects 62% of the world’s population in 64 countries meeting 35% of the world’s economy. China with its financial power will mainly finance this project, privilege Chinese contractors for the execution and set up bilateral trade and tariff agreements with the connected countries. The project will adjourn the world’s economy in an eastward direction and even more increase the influence of China in the world.

January 31, 2021 @ 11:33 am

Although this post is only slightly more than three years old by now, we can observe insightful changes when filtering the FORTUNE Global 500 list with 2020 figures descending from absolute profits.

Concentrating on the top five, we see the following results:

(1) Saudi Aramco (88k$)

(2) Berkshire Hathaway (81k$)

(3) Apple (55k$)

(4) Industrial & Commercial Bank of China (45k$)

(5) Microsoft (39k$)

Apple and the Industrial & Commercial Bank of China are still firmly in the saddle, however, slipped down on places three and four although having increased their absolute profits in 2020 (vs 2017) – a year with a massive economic impact in general (disregarding winners and losers of the COVID-19 pandemic).

The list is headed now by the foreign newcomer Saudi Aramco. Nevertheless, I would assume that their profits highly depend on the development of oil prices. Besides, Berkshire Hathaway as well as Microsoft are also within the top five.

I can fully relate to the industry bias in this kind of rankings. While being personally highly interested in China from an economic and language perspective, Chinese banks would not have come to my mind either when being asked the question you stated above. Nevertheless, I would assume students might guess correctly BH or Microsoft.

I completely agree with the conclusion that the world economy continues to change, but with regards to the “updated” version of 2020 I would like to add that also US based organizations play a key role in the game of globalization.

December 28, 2021 @ 9:11 pm

Understanding the global top five during this time as well as currently in 2022 is essential for collecting data in the ways that countries have profited through foreign exchange. It is very interesting that an American company held the first place spot for a top company, followed by a variety of Chinese businesses after China had not been compared in previous years. As China’s economy expands, the country has looked outward towards replacing the U.S. dollar with the Yuan as the world’s currency. Due to current globalization trends, this is very possible if the People’s Bank of China allows for free Yuan trade and if central banks decide to hold $700 billion Yuan within their foreign money reserves. Nevertheless, as top countries continue to engage in arbitrage and compete in global bonds, the process of adopting the Yuan is not impossible. Foreign exchange is an economic resource consisting of trading between outside countries that involve the conversion of two or more currencies. This all depends on the type of supply and demand that are predominantly prevailing in the marketplace of exchange. I believe that students and professionals are slightly more educated today on what countries are controlling and leading in the foreign exchange markets. In our International Business course, students attested to the fact that China has surpassed other leading export countries such as Japan and Germany. The United States however does have great exporting and importing relations with China as our deficit in profits was around 300 billion in the year 2020.